All Categories

Featured

Table of Contents

In Gwynn Oak, MD, Erika Levy and Rhett Velez Learned About Equipment Breakdown Coverage Vs Home Warranty

Homeowners warranty coverage is purely optional and not required by your home loan lender or anybody else. The genuine difference boils down to equipment and appliances in your house. As detailed as house owners insurance coverage might sound, there are a number of spaces. The latter normally does not cover mechanical devices in need of repair or replacement, unless they were unintentionally damaged by the particular hazards laid out in the policy, including: fire, weather or act of God.

Beyond this, house owners insurance coverage is implied to safeguard customers against damage brought on by natural catastrophes to the physical home and your individual property, together with some measure of liability protection. The dollar quantities for both coverage and tend to be greater in house insurance, that makes sense give the higher quantity of danger presumed by the business.

The house warranty would cover the repair of the pipe, but not damage caused by the leakage. If the leak was significant, your house owners insurance would cover the damage,", a Woodstock, Ga.-based realtor and lawyer, says. A house service warranty can provide a number of advantages, including: Peace of mind that your malfunctioning device or element will be fixed or replaced in a prompt manner, without causing you unnecessary monetary hardship.

"The previous owners of my 45-year-old home paid for the very first year of warranty coverage, and we have renewed it considering that," states Carol Gee, a house owner in Atlanta. "In the past, I questioned whether we should continue it. But recently, my hot water heater stopped working, and needing to acquire a new one would have cost me more than the yearly service warranty cost.

The costs included are reasonably inexpensive and can be thought about a rewarding investment compared to the complete expenditure of needing to replace or fix a costly home component. Oftentimes, the first 12 months of guarantee protection is included at no charge to the purchaser of a new or existing house, with the yearly fee spent for by the seller or property representative.

For example, a business may limit its coverage of an A/C system up to $1,500, which may be inadequate to spend for all the essential costs, or in a worst case scenario, replace it. The guarantee business may charge extra fees that fall outside of your coverage terms, such as the expense for carrying away an old device and its correct ecological disposal.

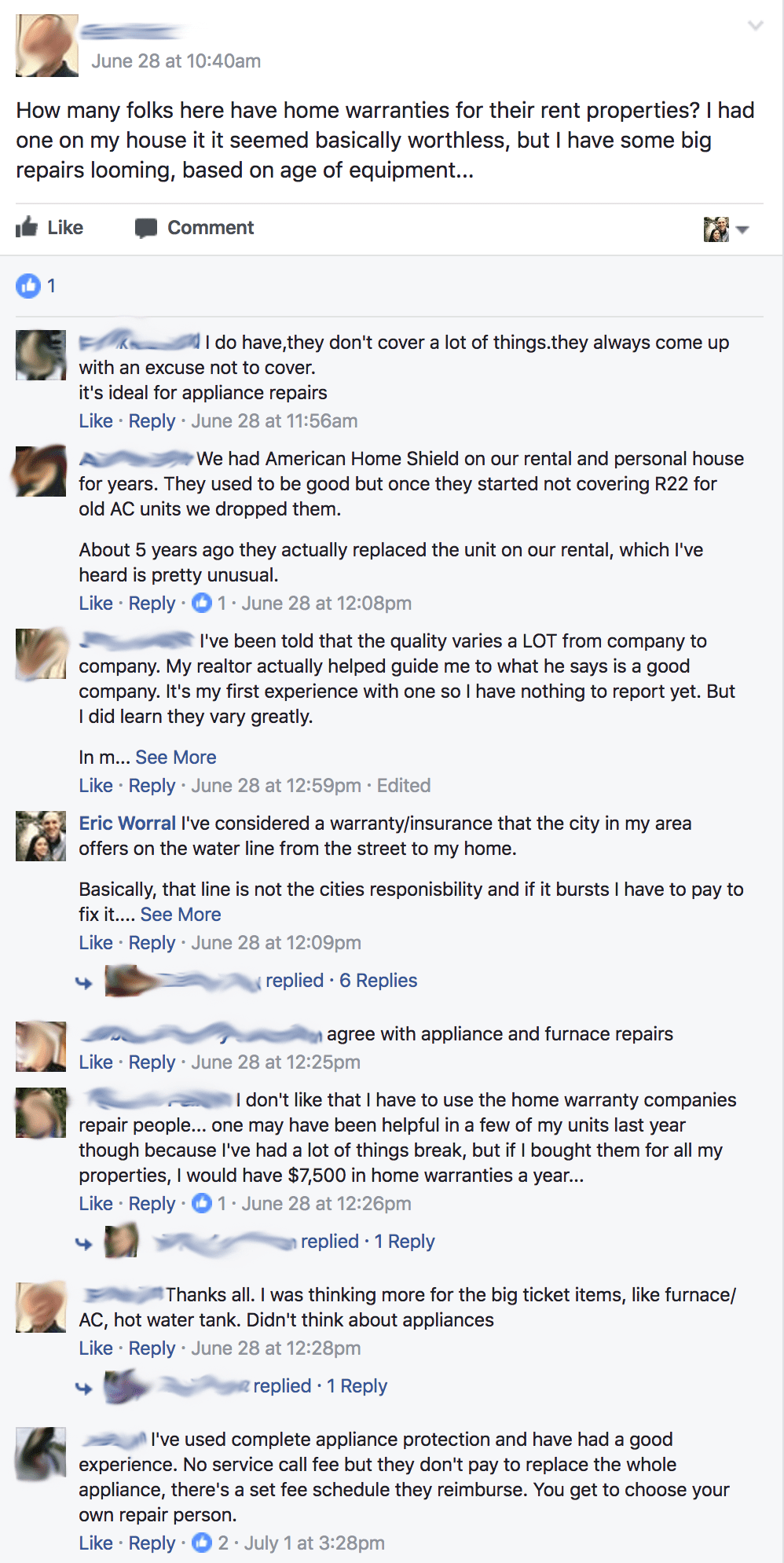

"I have a love/hate relationship with house guarantee business," says Ailion. "It's terrific when they cover an expensive repair work like an Air Conditioner system or heating system, but it's in some cases a fight to get the item covered and a dissatisfaction when the great print excludes some or all of the problem." Typically, you need to use the service provider/contractor dispatched by the service warranty business, and not an out-of-network repair work expert of your choosing.

In Mobile, AL, Sean Ayala and Seamus Pitts Learned About Equipment Breakdown Coverage Vs Home Warranty

Service warranty business also normally do not repay you if you attempt to do the work yourself or get an outdoors contractor. In theory, good home guarantee protection shields you from pricey repair work that property owners insurance coverage will not cover. Nevertheless, guarantee companies frequently omit assumed coverage for questionable factors and subjective technicalities, making it tough to recuperate the quantity you pay into the policy.

To much better figure out if a house warranty plan deserves the cash for your scenario, attempt to calculate the staying years of service you can count on for each appliance/system you're seeking to cover, along with the cost to replace each of those components. Compare the true expense of one repair or replacement with what you would likely pay to a guarantee company and one of its company; remember, however, that you might never ever even utilize your service warranty protection within your contract duration.

In addition, "service warranty protection is probably best for homeowners who do not have large cash reserves," Ailion states. Instead of buying a service warranty, consider regularly keeping and servicing your existing elements to extend durability and thoroughly looking into and searching for extremely ranked devices and systems with a better performance history of dependability; also, be prepared to replace a long-in-the tooth system, as quickly as it breaks down, with your completely researched replacement item.

and the company that it partners with: are they close by, trustworthy, and accredited, bonded and insured? How are they rated by your local Better Company Bureau? If you haven't yet closed on your house purchase, speak with your house inspector. "This professional is finest fit to tell you when the home's home appliances and systems may fail and if service warranty coverage is worth it for this specific home," says Hackett.

Owning a house is the one of the biggest financial investments you'll make in your life. Securing your possessions is not simply smartit's integral. The finest method to do this is to acquire both a property owner's insurance policy and a home warranty. Acquiring both will cover your house, possessions, home appliances and system elements in case they need replacement or repair work.

What is property owners insurance? A home insurance coverage covers any unintentional damage to your home and belongings due to theft, storms, fires, and some natural disasters. There are four primary areas covered under the policy: the exterior and interior of your home, personal effects in case of theft, loss or damage, and general liability that can arise when a person is injured while on your home.

A policy is renewed yearly, and its average annual expense is between $300 and $1000. All house insurance coverage policies offer a deductible, which is what you'll pay when a claim is made. The policy will then take care of any additional expenses. So for instance, state a pipe breaks and floods your cooking area.

In Ankeny, IA, Jaidyn Campbell and Natalya Barajas Learned About Difference Between Homeowners Insurance And Home Warranty

As soon as the claim is authorized, the insurance provider will deduct the amount of your deductible and problem you a payment for the rest of balance to repair your house. This deductible can also assist in lowering your annual policy premium. The greater your deductible, the lower your annual house insurance coverage will cost.

For instance, elements of your A/C, electrical, and pipes, kitchen area home appliances and washer/dryer are all normally covered under this warranty. You can likewise cover bigger systems like your swimming pool and health spa. House warranties generally have 12-month agreement terms, and are not mandatory to get a mortgage. A house warranty is simply optional, but it's a clever purchase.

So let's state your A/C system stops working. Because case, a licensed, pre-screened specialist will come out and evaluate the issue. If it's determined that the system is no longer working since of age or wear and tear and the breakdown is covered under the terms of your service agreement, the service specialist will make the repair, or if essential, will replace the appliance or system for simply the expense of your service call.

The protection of a house service warranty possibly can save you hundreds or perhaps thousands of out-of-pocket dollars and the headache of finding a relied on service professional to make the repairs. Let's face it life takes place and things break. When they do, a home guarantee from American House Guard can make it simpler to get a certified expert on the case while keeping your budget in line.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. Nevertheless, this does not affect our assessments. Our viewpoints are our own. When Courtney St. Gemme-Chandler and her partner purchased an older home in Aurora, Colorado, in 2012, they assumed it would require some small TLC.

Right after they relocated, a pipe burst under the concrete in the basement. That was followed by a broken dishwasher, a nonfunctioning electrical panel and malfunctioning electrical wiring. Luckily, the couple's real estate representative had purchased a house guarantee for them as a closing gift. None of these issues had shown up during their home evaluation.

While house owners insurance coverage safeguards your home against unanticipated circumstances, a home service warranty, which costs approximately $550 annually, is a convenience program that covers the typical wear and tear on the significant mechanical and electrical systems in a house, states Art Chartrand, counsel and administrator of the National Home Service Contract Association.

In South Windsor, CT, Warren Brewer and Gideon Randall Learned About Difference Between Homeowners Insurance And Home Warranty

House warranties, likewise called home service agreements, are nothing new, however more real estate agents have actually advised them in recent years as the real estate market has actually been flooded with foreclosures and brief sales residential or commercial properties that were often overlooked or badly kept. "A house service warranty is like an insurance coverage that secures you after the house sale, however you need to pay close attention to what is and isn't covered," states Tony Martinez, a realty representative with Re/Max North San Antonio in San Antonio, Texas.

Some likewise mistakenly believe that the policies function as emergency house service contracts, meaning the issue will be detected and fixed within hours, which isn't the case. When you sue, your house warranty business selects a regional contractor that's been vetted and sends it out to diagnose your issue for a set service charge, which you are accountable for paying. Be careful of scammers who might use a half-price house guarantee agreement, then disappear when you try to file a claim, Chartrand states. Customers should beware of such offers and research house warranty providers prior to picking one. A house evaluation will not reveal every significant issue, however it can lay the foundation for getting the most from your home service warranty.

Some home service warranty companies, for example, won't cover an cooling unit that hasn't been serviced within a particular timespan; that's a product worth negotiating with the seller prior to closing, Martinez says. Deborah Kearns is a personnel writer at NerdWallet, an individual financing website. Email: [email safeguarded]. Twitter: @debbie_kearns This article was composed by NerdWallet and was originally released by U.S.A. Today.

Wednesday, February 03, 2016 Homeowners insurance coverage is much various than a home service warranty. Your house owners policy generally covers the following: structure of the home, individual valuables, liability defense (usually from injury, slip-and-fall, and so on), natural catastrophes, terrorism (an extra fee may use), flooding, fire, and theft just to name a few.

A house warranty is a service contract that covers the repair work or replacement of home appliances and home systems that break down over time. From a/c systems to kitchen home appliances, our plans help cover damage and malfunction brought on by everyday wear and tear. When something that is covered by our house service warranty contract breaks down, the property owner puts in a Service Request Ticket with us and then picks a licensed company of their choice to take a look at the problem.

As a covered house owner, you only pay a little service call fee, comparable to a deductible. A home warranty is usually bought to protect versus pricey, unforeseen repair work expenses and provide assurance, understanding that repairing or changing covered devices and house systems will not break the spending plan. For those on a set income, a house service warranty strategy can be a helpful budgeting tool.

what is the difference between home warranty and home insuranceHouse warranties likewise make sense for people who aren't convenient, do not have knowledge or who don't have the time to fix a home system or device when it breaks down. The topic of home warranties typically comes up during the sale and purchase of a home. A home warranty can supply reassurance to a homebuyer who has restricted information about how well the home's elements have been preserved, or how well they have actually been installed, when it comes to brand-new construction.

For small business owners, OnPoint Warranty can help you cut costs for your high-quality business laptops and cellphones. OnPoint Warranty is an affordable solution for your employees who are always on the go. And since many devices like these need to be replaced every two years, OnPoint Warranty is an excellent solution for anyone looking to avoid unexpected costs. If you're looking to purchase insurance for any aspect of your technology, OnPoint Warranty is the company that will be there when you need them most.

If you're looking for an Insuretech partner to help you do the heavy lifting, OnPoint Warranty is the company for you.

They provide a flexible warranty solution to fit your needs. With their comprehensive insurance coverage, we cover both the device and any third-party costs that might arise throughout its lifecycle. You can extend coverage up to three years with an affordable monthly fee.

Table of Contents

Latest Posts

Soundproof Egg Tips and Tricks

In Fayetteville, NC, Xavier Gilmore and Iliana Sutton Learned About Equipment Breakdown Coverage Vs Home Warranty

In Cedar Rapids, IA, Triston Pace and Matthew Odonnell Learned About Difference Between Homeowners Insurance And Home Warranty

More

Latest Posts

Soundproof Egg Tips and Tricks

In Fayetteville, NC, Xavier Gilmore and Iliana Sutton Learned About Equipment Breakdown Coverage Vs Home Warranty

In Cedar Rapids, IA, Triston Pace and Matthew Odonnell Learned About Difference Between Homeowners Insurance And Home Warranty